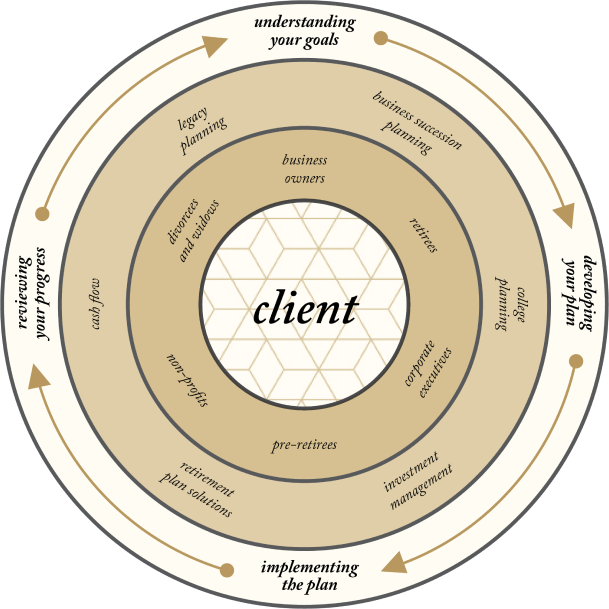

Our Strategic Process

Goal-Driven Investment Guidance

Fulfilling our fiduciary duty to put you first, our team’s process helps ensure that when we’re making financial decisions on your behalf, they are always consistent with the goals you’ve outlined, and they help deliver outcomes that are important to you.

Because you—the client—are at the center of this strategic process, our financial advisors are able to form an understanding of your unique objectives, develop a plan around those objectives, implement said plan using our suite of solutions, and review the plan to keep you on track toward a fruitful future.

Understanding Your Goals

Our investment process begins with a comprehensive profile of your present financial resources, liabilities, and investment objectives. The profile we develop from this discovery session will serve as a road map of your goals and risk tolerance, and it acts as the basis for all subsequent investment recommendations.

Developing A Plan

When developing an investment strategy specific to your goals and investment objectives, we use sophisticated software to help you stay on track and help ensure you’ll enjoy your retirement without living beyond your wealth. Our recommendations are based on preservation of principal first and growth of capital second, and they may evolve if opportunities for improvement arise.

Implementing The Plan

We believe it’s imperative for you to understand your customized investment strategy, and we’ll make sure you are comfortable with all aspects of the plan. Once you approve the plan, we will fully implement your investment strategy. Based in Scottsdale, Arizona, our advisory practice is primarily fee-based, and our independence provides us freedom from commission-based sales and proprietary products.

Reviewing Your Progress

Specifically for our advisory clients, we are uniquely committed to keeping our lines of communication open with you. This ongoing effort helps to maintain a deep understanding of your financial goals, and our group of CERTIFIED FINANCIAL PLANNER™ professionals will review your plan to evaluate current investments in relation to your original goals and any new objectives. We also ask to be notified of any changes in your life so that we can adjust your portfolio if needed. The process then continues and repeats its steps.