By Larry Van Quathem, CFP®

When you look at your little one, it might be hard to imagine that one day you’ll be buying amenities for a dorm room when you’re still buying diapers on a weekly basis. As college tuition keeps increasing, by the time your 18-month-old turns 18, what will four years of college tuition be?

Starting a college fund early on is a great way to keep pace with rising tuition—and help prepare your child for their dream college education.

1. Collect the Facts

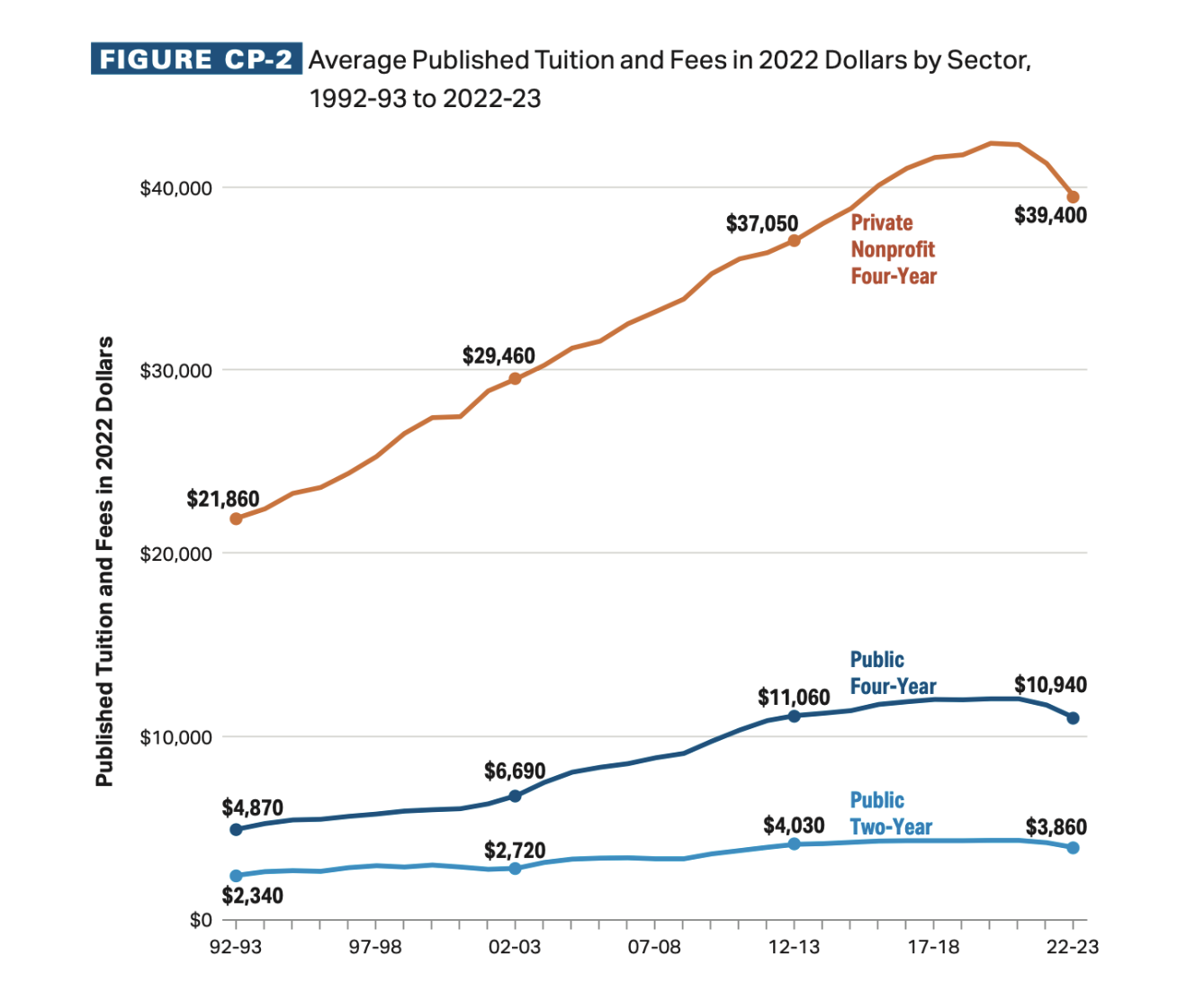

College tuition gets more expensive every year, and the numbers can cause anyone to break out in a sweat. The average sticker price for a private college for the 2022-23 school year was nearly $40,000.

The following table shows the average cost of tuition over the last 20 years:

Source: College Board, Trends in College Pricing and Student Aid 2022, Figure CP-2.

Even though the drastic hikes have recently tapered, if the upward trend continues, in 2040 a 4-year private college could cost nearly $100,000 per year. The costs will vary depending on the university attended, room and board, and other expenses, but either way, it’s best to start prepping now.

For college graduates, the average student loan debt is $37,000 and the average monthly student loan payment is $460. For students just beginning their careers, that’s a large bill to pay each month. The substantial costs may be overwhelming, but knowing what to expect gives you a goal to aim for.

2. Start Saving

It’s never too late or too early to start saving for your child’s college fund. By starting early, you can reap the rewards of compound interest. If you wait, your account balance may not be as high, but you are still investing something toward your child’s future.

Even if you don’t think you have enough room in your budget to add another line item, $25 a month is still $25 more than $0. Setting up automatic contributions is a good way to remind yourself that college is getting closer, and your monthly account statement will keep this goal at the forefront of your mind. You can also make it a goal to save extra money from a raise or a bonus and invest it in your child’s future.

3. Different Ways to Save

The most common method people use to save for college is through a 529 plan. A 529 plan is a state-sponsored education savings account that allows earnings to grow on a tax-deferred basis. There are two categories of 529 plans: prepaid tuition plans and college savings plans.

Prepaid plans let you pay future tuition costs at today’s prices, which, considering skyrocketing college costs, can be enticing. On the other hand, college savings plans have no age or income restrictions and allow you to save anywhere from $235,000 to $550,000 per child, and then use it, tax-free, for qualified education expenses. As an added benefit, you are not limited to using the plan offered by the state in which you live. Some states will give you a tax credit for using their plan, but, in many cases, it’s worth it to shop around.

Beyond 529 plans, some families use Roth IRAs. Your Roth contributions can be withdrawn at any time and can be used for any purpose. In addition, Roth IRAs offer virtually unlimited investment options. And, IRAs will not have any impact on your financial aid eligibility.

For college savings, Roth IRAs aren’t the perfect option, but they do offer an alternative to traditional 529 plans. Think about opening a 529 plan for college and also continuing to contribute to a Roth for retirement. This strategy gives you extra resources to draw on if you need them.

4. Diversify Your Savings

While some people are able to save and pay for the total cost of their children’s college educations, most people don’t fit into this category. Instead of letting that fact get you down, break the cost of college into thirds.

The first step is to save before your children head off to college. By starting early and having some help from the markets, you can accumulate a solid base to use for tuition and room and board. The next step is to plan on paying for about one-third of the costs while your child is in college. This can be through a combination of scholarships, grants, a part-time job for your child, or contributions from the family. The final piece is student loans that your child or you can repay after he or she has completed college. Since the goal would be to minimize student loans, try to maximize the first two parts of this three-pronged strategy first.

5. Check Your Progress

Just like your 401(k) plan, your college planning investments need to be monitored. In the early days of saving for college, you’ll want to be more aggressive with your investments, but as college draws closer, the investment allocation should become more conservative—just like a retirement account. Some 529 plans even offer age-based investment options that automatically become more conservative as your child gets older. It is also helpful to monitor your balances, keep an eye on the changing college costs, and track your progress toward your goal.

If saving for college is a strategy you’d like to integrate into your financial plan, we at ABLE Financial Group would love the opportunity to sit down with you to understand your financial goals and develop a plan accordingly.

To learn more about our team and the ways we can help guide you, call 480.258.6108 or email larry@ablefinancialgroup.com today.

About Larry

Larry Van Quathem is Senior Financial Advisor at ABLE Financial Group, a financial services practice that focuses on transition planning and simplifying the complexities of their clients’ wealth. Larry is an Arizona native who grew up in the financial services industry, as his father, Bob, became a Financial Consultant for Merrill Lynch when Larry was just seven years old. After earning a Bachelor of Science in Finance from the University of Arizona in 1993, Larry followed in his father’s footsteps just two years later. They worked together for more than a decade before Bob retired in 2009, and after gaining 20 years of experience at Merrill Lynch, Larry joined ABLE Financial Group in 2015. He saw it as a great opportunity to increase the quality of service for his clients and to have more control over how that service is delivered.

As a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional, Larry excels at listening to each client’s personal goals and then offering various approaches to help achieve those goals using a written plan of action. He creates a personalized service model for every client, enabling him to serve as a financial coach for his clients and make sure they are taking appropriate action to help reach their investment objectives and life goals.

Larry also likes to spend his time getting involved in the community, and he is currently serving on the Board of Directors for the Delta Sigma Pi Leadership Foundation. In the past, he has served on the Board of Directors for the Association for Supportive Child Care, and he is a past active member of the Scottsdale 20-30 club. Professionally, Larry has been a member of the Central Arizona Estate Planning Council since 2010. Larry lives in Phoenix with his son Jake. When he is not busy servicing his clients, he enjoys golf and playing with his French Bulldogs, Rocky and Birdie.